1. Report Summary:

AI has skyrocketed this year, driving massive momentum for AI infrastructure companies.

Amidst this surge, many BTC miners are repurposing their power supplies for AI and high-performance computing (HPC).

This strategic shift has significantly boosted investor confidence, driving the stock up by over 80% in the past month.

Source: Iren

2. Company Overview:

Renewable Energy Powerhouses: Iris Energy (IREN) operates data centers in British Columbia and Texas, powered by 100% renewable energy.

Multi-Faceted Operations: These centers support Bitcoin mining, AI cloud services, and energy trading operations.

Significant Funding Boost: IREN recently raised approximately $413 million through stock offerings to fund expansion.

Experienced Leadership: Founded in 2018 by brothers Dan and Will Roberts, former Macquarie executives, headquartered in Sydney, Australia.

Strategic AI Shift: IREN has replaced Bitcoin ASICs with Nvidia H100 chips, enabling AI startups to access their data centers for AI model training.

Stock Price Surge: Following its pivot to AI, IREN's stock price has surged significantly, reflecting strong investor confidence in its new direction.

Source: Google

3. Industry Shifts: BTC Miners Embrace AI

As AI companies strive to enhance their products, the demand for cheap, abundant energy has soared.

BTC miners, with their large-scale energy infrastructures, are now swapping mining rigs for AI systems, seeking more stable revenue sources.

Over the past 30 days, 11/15 of the biggest BTC mining stocks performed positively, compared to BTC which is down over 10%.

Source: CompaniesMarketCap

4. Growth Opportunity In AI & Data Centers:

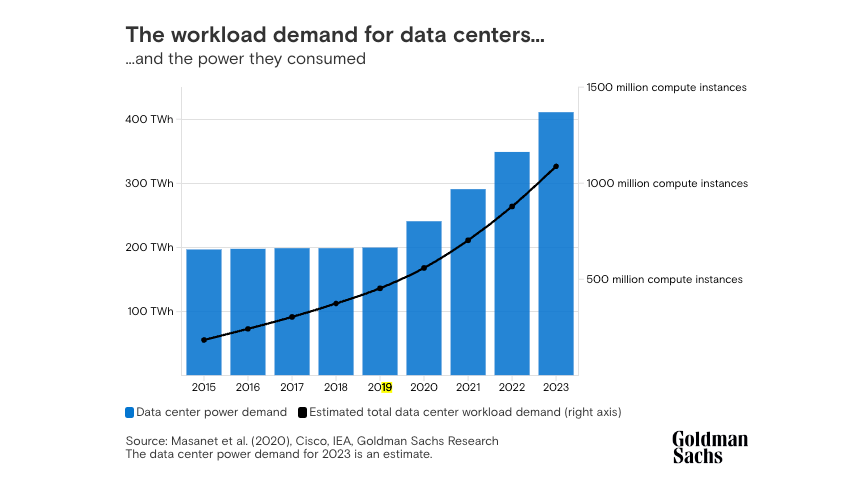

Goldman Sachs Research estimates a 160% growth in data center power demand by 2030, driven by the AI revolution.

Currently, data centers consume 1-2% of global power, a figure expected to rise to 3-4% by the decade's end.

The AI-driven increase in power consumption is projected to reach 200 terawatt-hours per year by 2028, with AI accounting for about 19% of data center power demand.

Source: Goldman Sachs

6. Iris Energy’s AI Developments:

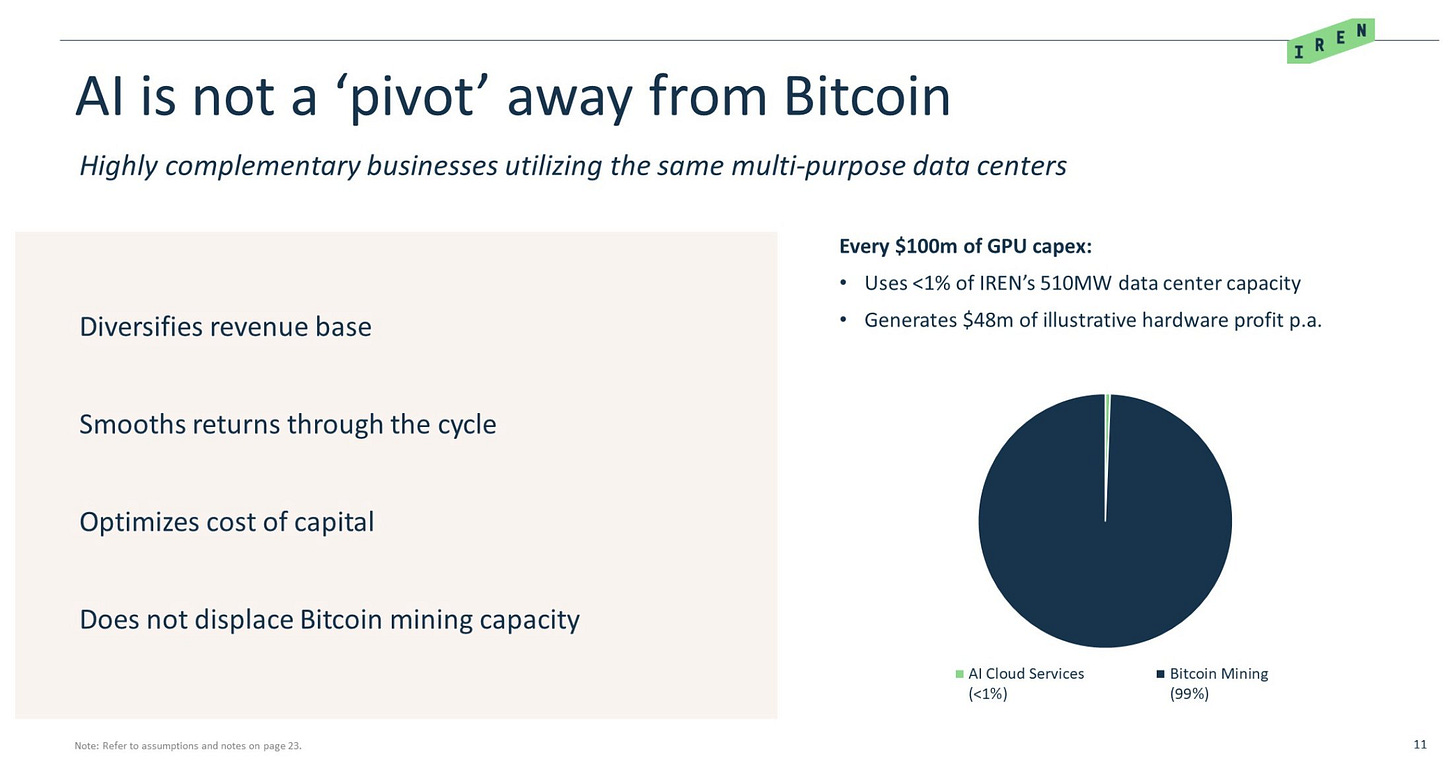

Despite AI cloud service revenues being relatively insignificant compared to BTC mining, IREN management has reported bullish developments.

Nvidia GPUs, such as the A100 and H100, require high rack densities for optimal performance, a challenge IREN meets through its extensive land and power portfolio.

Source: Iren

7. Financial Performance & Benchmarking

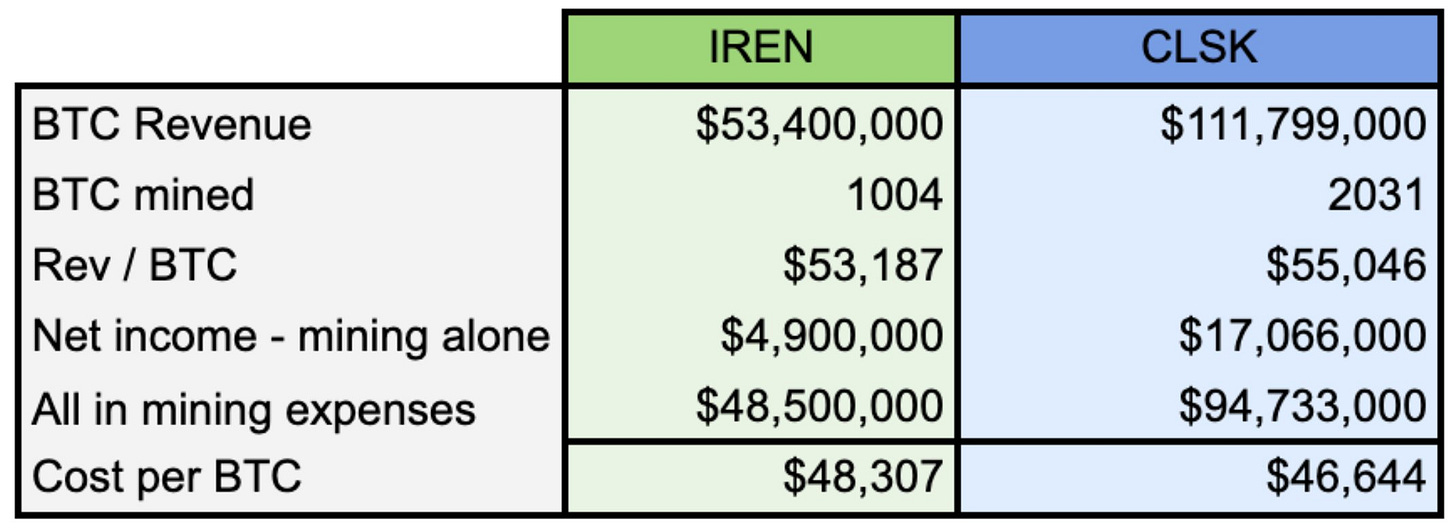

IREN has emerged as one of the most profitable BTC miners, rivaling peers like CLSK in all-in cost per BTC.

However, these pre-halving figures (January-March 2024) may not reflect the current post-halving costs.

Source: grippa_Inv

8. Leadership & Management:

Led by Dan and Will Roberts, IREN’s management team boasts an impressive track record, having delivered over $25 billion in projects globally.

The Roberts brothers collectively own about 5.4% of the company, with compensation plans tied to long-term shareholder value creation.

The team is active in the community, engaging with retail shareholders and maintaining ambitious timelines.

Source: Iren

9. Future Projections For Iris Energy:

IREN has exceeded expectations with forward-looking guidance.

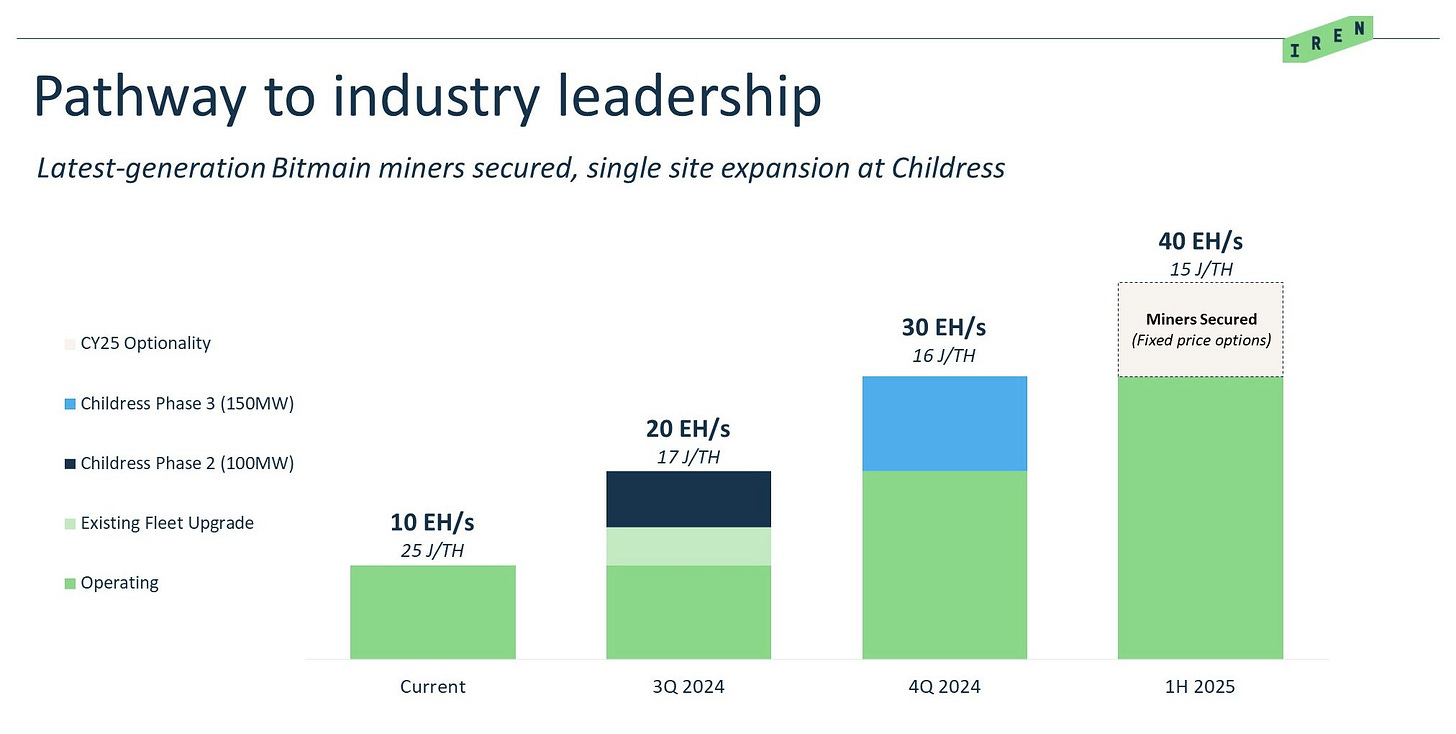

Currently, IREN operates at around 10 EH/s, with higher hash rates translating to more Bitcoins mined.

Management increased their H2 2024 hash rate guidance from 20 EH/s to 30 EH/s, with a target of 40 EH/s by H1 2025.

Source: Agrippa_inv

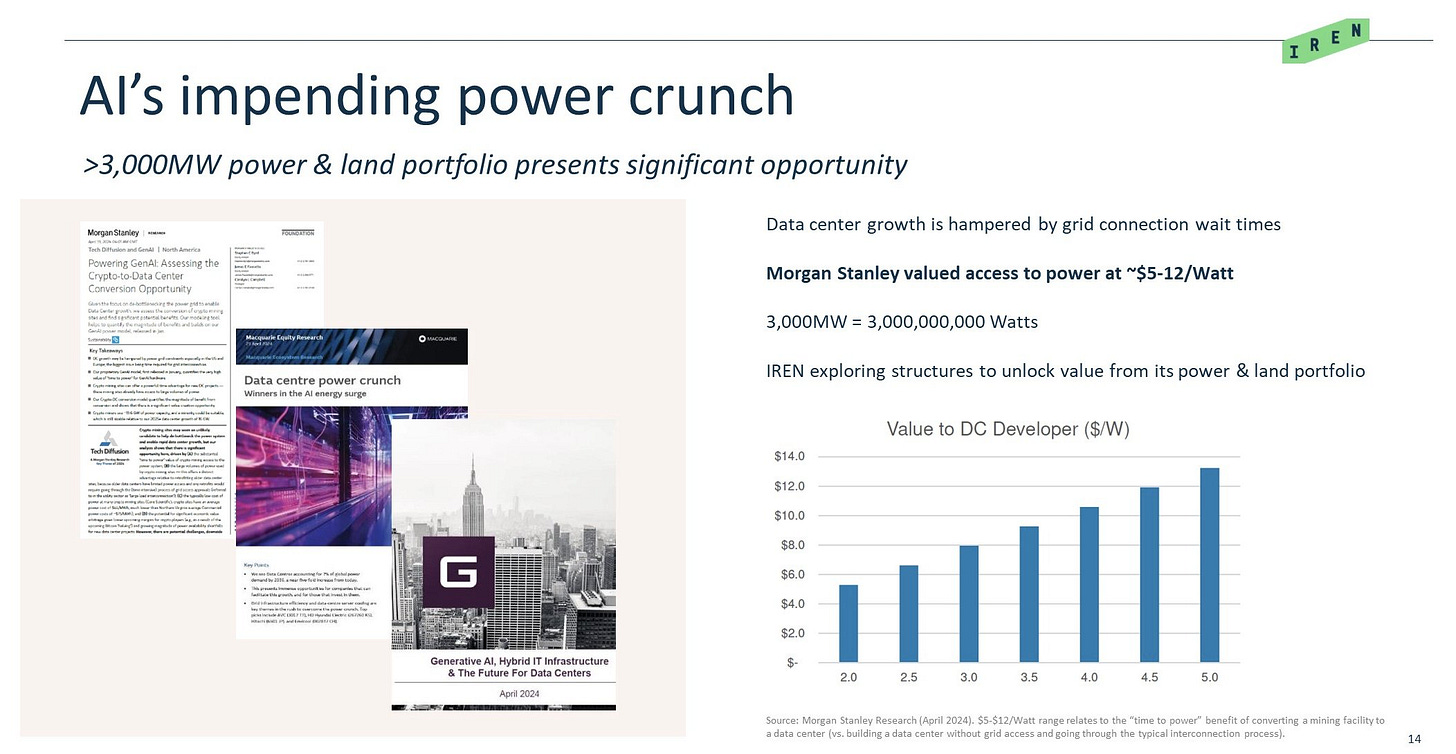

Morgan Stanley values power access at $5-12 per watt, suggesting a potential market cap of $15-36 billion for IREN based on their power portfolio.

Source: Agrippa_inv

10. BTC Mining Challenges:

BTC mining has historically been profitable but is subject to market volatility. The 2024 Bitcoin halving, which reduced miner rewards, has posed new challenges.

Miners who survived the crypto winter have reaped profits, but post-halving profitability remains uncertain.

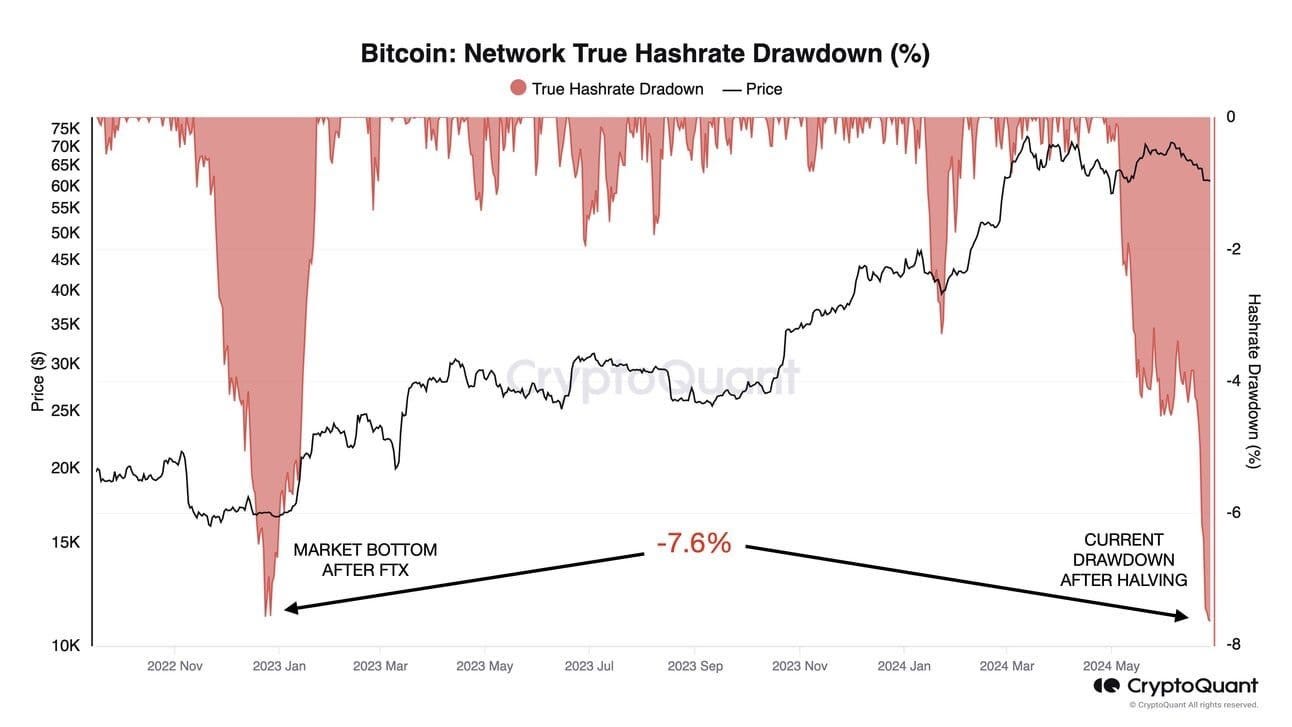

The BTC network's hash rate is approaching levels seen during the FTX crisis, suggesting potential miner capitulation.

Source: CryptoQuant

Large-scale BTC mining has also faced criticism for its environmental impact, leading to increased regulatory scrutiny.

IREN’s focus on renewable energy sources may mitigate some of these concerns, positioning the company favourably in a market increasingly aware of sustainability.

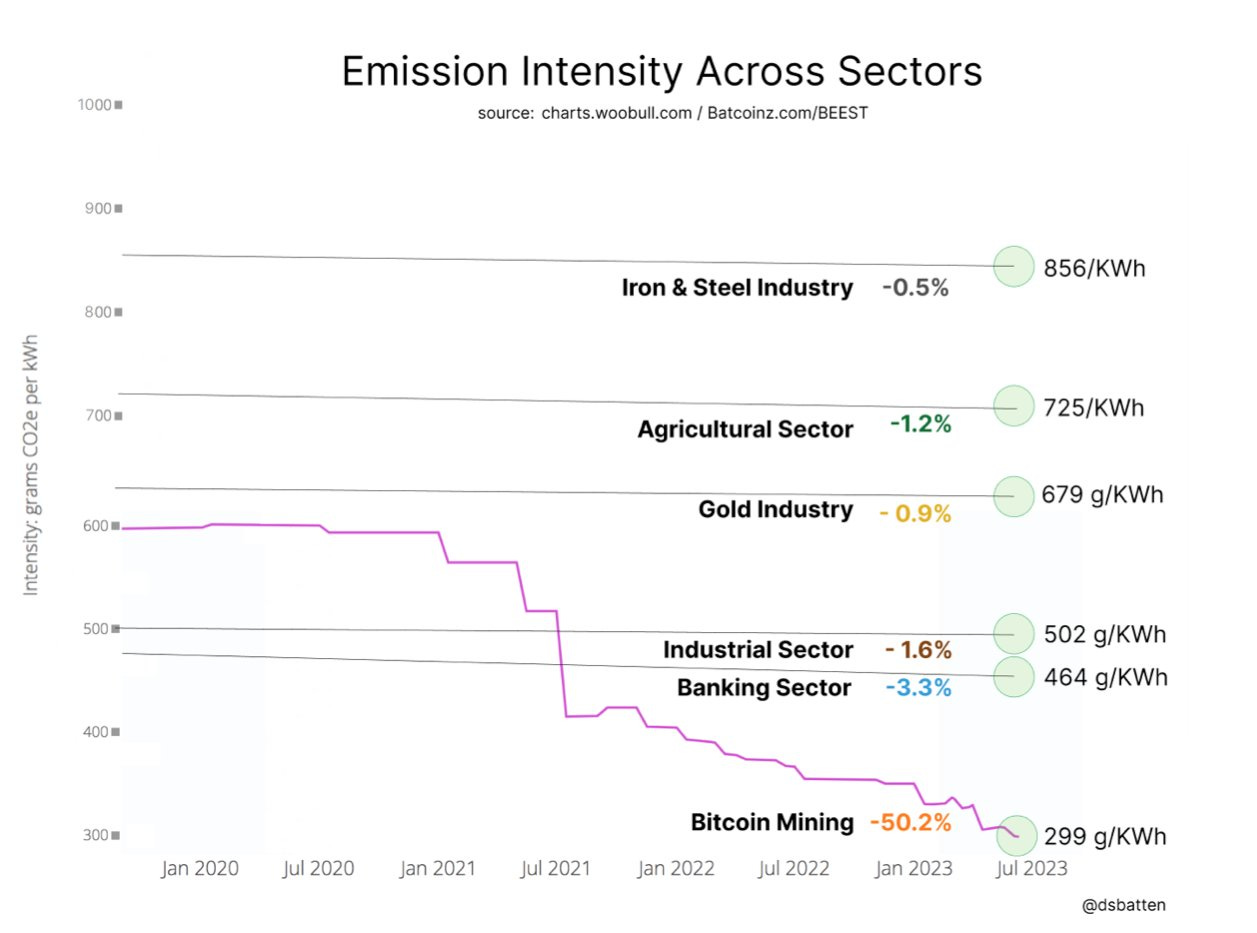

BTC has systematically reduced its emission intensity over the past four years:

Source: Crypto Slate

11. Key Risks:

Volatility & Speculation: IREN’s 70% montly surge raises concerns about speculative growth driven by AI hype rather than financial performance.

Bitcoin Mining Risks: The 2024 halving reduced mining rewards, impacting profitability amid cryto market volatility.

Execution Risks: Transitioning to AI hosting involves major operational changes; missteps could affect financial performance and growth.

12. Final Thoughts:

The shift towards computational power offers BTC miners like IREN and CORZ a significant opportunity.

Diversifying into AI is crucial for managing post-halving volatility. IREN’s renewable energy focus and AI pivot position it well to capitalize on these trends.

IREN’s recovery from being oversold in the crypto market is strong, but continued revenue diversification via AI is essential.

Disclaimer:

Please note that all content is for informational purposes only and should not be considered financial advice. For full details, see the disclaimer.