1. Smarter AI Needs More Memory:

The memory chip market, typically cyclical, is undergoing a massive shift.

After a year-long downturn, the sector is now poised for a sustained boom.

The surge is fueled by soaring AI demand, with platforms like ChatGPT creating an enormous need for memory chips.

Source: South China Morning Post

2. Essential Tech Commodities: Memory Chips

The term "commodity" often brings to mind raw materials like oil, but it also includes crucial tech components such as memory chips.

AI demand is fundamentally transforming the memory industry, reshaping its product landscape.

These chips are vital for emerging technologies like AI, robotics, and advanced electronics.

DRAM, NAND flash, HDD, and even magnetic tape vendors stand to benefit from the growing demand for storage and memory.

Source: Samsung, Citi Research

3. Market Opportunity For Memory Manufacturers:

Manufacturers like Micron (MU) benefit from strong capital expenditure and play key roles in high-demand areas like AI.

With a market dominated by a few major players, these companies wield significant pricing power and enjoy high margins.

Citi research identifies three areas of AI demand surge that will shape the memory space:

AI Super Computing for training and inference of Large Language Models (LLM)

On-device AI to manage AI processing workloads at the edge device level

Memory Pooling to improve the efficiency of high-capacity data management

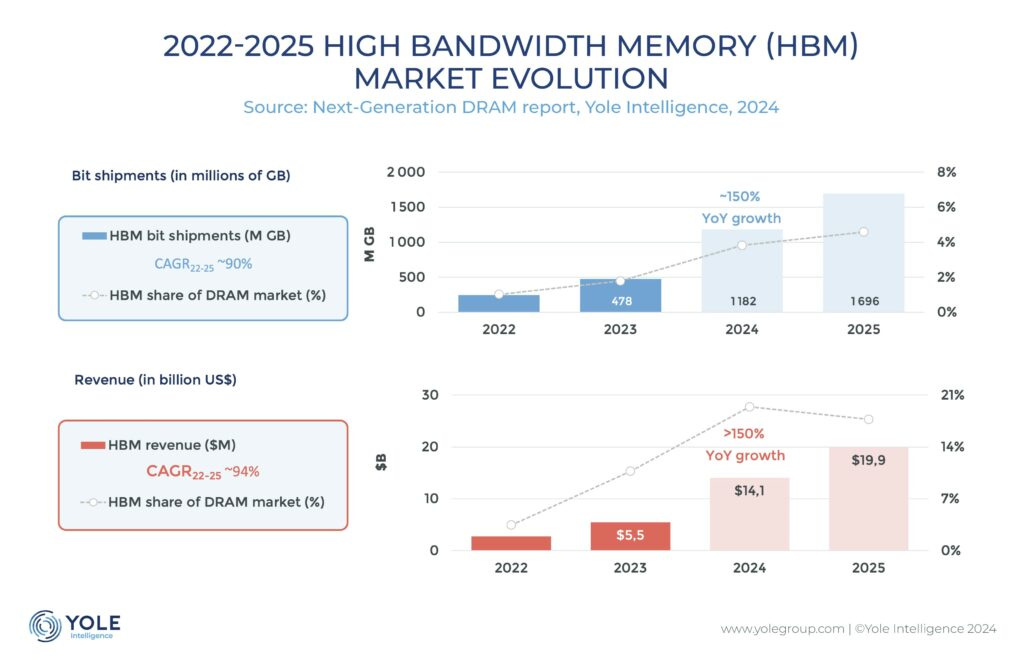

4. High Bandwidth Memory (HBM) Drives AI Innovation:

High Bandwidth Memory (HBM) is crucial for AI systems, offering high bandwidth and low power consumption to manage large data volumes in AI applications.

This shift to HBM fuels market growth, while demand for older chips in PCs and mobile devices remains flat.

Source: Yole Group

The need to increase bandwidth drives suppliers to innovate and commercialize new generations of HBM.

SPGlobal analysts forecast continued growth in the memory market, fueled by AI investments and a broader sector recovery.

Source: SPGlobal

5. Competitive Landscape:

The memory market is dominated by three main players:

SK Hynix: A leader in HBM supply, mainly listed in Korea and Luxembourg, making it harder to buy shares.

Samsung: A large, diversified company offering less direct exposure to memory.

Micron: An American firm likely to gain more market share, also supplying to NVIDIA.

Few companies sell memory in large quantities, giving them pricing power and high margins due to limited competition.

(i) Market Segmentation:

Memory manufacturing is divided into two types:

DRAM: Temporary computer memory used for multitasking, commonly known as ‘RAM’.

NAND Flash: High-speed storage used in modern devices.

There are three main players in DRAM and six key players in NAND.

Source: Seeking Alpha

6. Micron Technology, Inc. (MU):

Micron Technology, the top U.S. memory chip producer, focuses on manufacturing DRAM and NAND Flash.

(i) Recent Performance:

Q3 FY2024 revenue: $6.8 billion (up 81.5% year-on-year)

Net profit: $332 million (compared to a $1.9 billion net loss last year)

(ii) Key Drivers:

Surge in AI server memory demand

Robust price increases due to improving supply-demand conditions

Strengthened product mix enhancing profitability across all markets

(iii) Key Consideration:

Micron faces competition from larger corporations with more significant market share and resources

Source: Yahoo Finance

7. Samsung Electronics Co., Ltd. (005930.KS):

Samsung is the largest player in the memory industry with 42% market share in DRAM and 33% in NAND.

However, it’s a highly diversified conglomerate, encompassing smartphones, appliances, and more.

(i) Recent Performance:

Q2 operating profit: 10.4 trillion won (US$7.5 billion), a 15-fold increase

Sales growth: 23%, the largest rise since 2021

Stock up 3% to its highest since January 2021

(ii) Key Drivers:

Demand for AI servers and data storage boosted DRAM and NAND prices

Reversal of inventory valuation losses

(iii) Key Consideration:

Investing in Samsung means gaining exposure to a wide range of businesses beyond memory chips

Source: Yahoo Finance

8. SK Hynix Inc. (000660.KS):

SK Hynix, a pure play in the memory market, manufactures, distributes, and sells semiconductor products globally

It is a leader in high-bandwidth memory for NVIDIA’s AI accelerators.

(i) Recent Performance:

Q1 revenue: 12.4 trillion won (US$9 billion), up 144% year-on-year

Operating income: 2.89 trillion won, the second-highest first-quarter profit on record, beating estimates of 1.8 trillion won

(ii) Key Drivers:

In a rebound phase, with rapid revenue growth

Preparing for significant investments to expand capacity for advanced chips

(iii) Considerations:

Part of South Korea's SK Group, which has faced challenges, including losses in its electric vehicle battery unit

Source: Yahoo Finance

9. Key Risks:

Volatility in Memory Chip Prices: Significant fluctuations in DRAM and NAND prices impact average selling prices.

Uncertain Government Incentives: Achieving or maintaining outcomes and compliance with government incentives is not guaranteed.

Gross Margin Pressures: Influenced by changes in technologies, inflation, and higher manufacturing costs.

Geopolitical and International Risks: Restrictions on sales and geopolitical tensions can adversely affect operations.

Intense Competition: The semiconductor memory and storage markets are highly competitive.

AI Hype and Cyclical Nature: AI hype can lead to high P/E ratios, and the sector is subject to cyclical downturns and upswings.

10. Conclusion:

The memory chip market is set for prolonged growth, driven by AI demand and a recovery from last year's downturn.

AI-Driven Demand: High-bandwidth memory (HBM) is essential for AI, boosting performance for server-based and edge-based systems.

Market Dynamics: Major players like Micron, SK Hynix, and Samsung have significant market shares, enabling strong pricing power and high margins.

Technological Investment: Companies are expanding capacity and innovating advanced chip technologies to meet growing demand.

Sector Resilience: Despite risks like price volatility and competition, the market's fundamentals remain strong.

While the outlook is promising, consider risks such as price volatility, geopolitical tensions, cyclical risks, and AI hype.

Disclaimer:

Please note that all content is for informational purposes only and should not be considered financial advice. For full details, see the disclaimer.